Investment proposition

Stoneweg Europe Stapled Trust (“SERT’) offers the opportunity to invest in attractive European freehold commercial real estate with trusted Managers and experienced local Property Manager.

Investment strategy

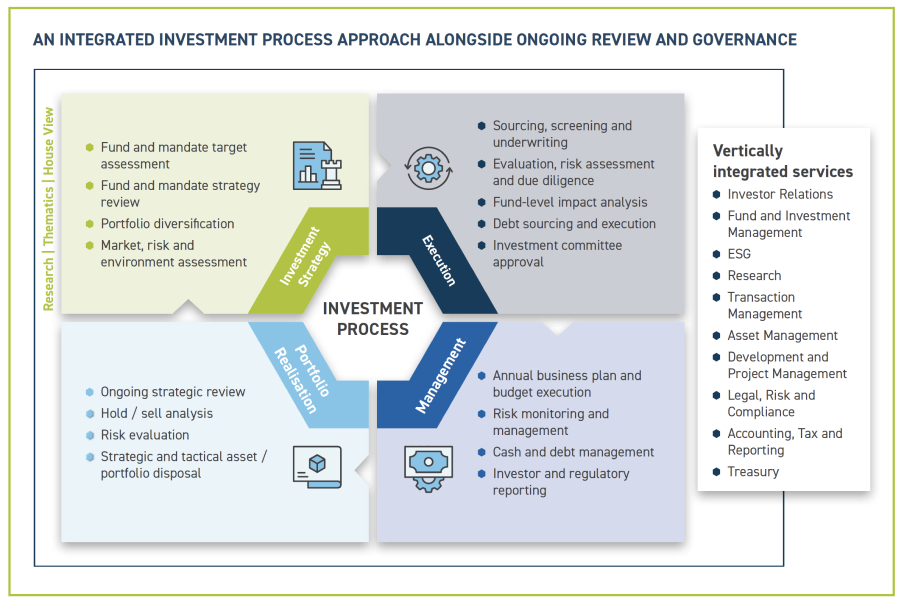

Stoneweg Europe Stapled Trust (“SERT”) is a stapled group comprising Stoneweg European Real Estate Investment Trust and Stoneweg European Business Trust. SERT is a growth-ready European logistics and data centre platform with resilient income and a clear path to long-term value creation, backed by a well-aligned sponsor ecosystem. SERT aims to provide sustainable distributions through active asset management and a disciplined approach to portfolio construction.

SERT has a principal mandate to invest, directly or indirectly, in income-producing commercial real estate assets across Europe. SERT is strategically focused on its highest-conviction sectors – logistics and data centres – while selectively pursuing value-add redevelopment opportunities to enhance portfolio quality and earnings resilience. At present, SERT has close to 90% exposure to Western Europe and close to 60% exposure to the logistics, light industrial and data centre sectors, with a medium-term goal of increasing its exposure to these sectors to a vast majority weighting.

SERT’s portfolio is valued at approximately €2.2 billion and comprises over 90 predominantly freehold properties located in or near major gateway cities in the Netherlands, Italy, France, Poland, Germany, Finland, Denmark, the Czech Republic and the United Kingdom. The portfolio spans approximately 1.6 million sqm of lettable area and serves more than 700 tenant-customers, providing a diversified income base that supports sustainable distributions.

SERT is an early investor with 6.7% stake in the Sponsor’s data centre development platform, AiOnX, which is expected to drive long-term valuation and earnings upside, subject to development execution and market conditions.

SERT is listed on the Singapore Exchange Limited (SGX counter: SET (Euro) and SEB (SGD)) and is managed by Stoneweg EREIT Management Pte. Ltd. and Stoneweg EBT Management Pte. Ltd. (collectively the “Manager”). SERT’s sponsor is SWI Group, comprising Stoneweg, Icona Capital, its subsidiaries and associates. SWI Group holds a substantial 28% stake in SERT’s stapled securities and wholly owns the Manager and Property Manager.

Active asset management and asset rejuvenation

Capital recycling, sustainable developments and AEIs

Responsible capital management

High ESG standards and disclosures